My 3 tips to get financially literate

Hey brothers and sisters,

personally, I find it crucial to get financially educated, or how others call it; financially literate. When being an adult, financial illiteracy could be your worst flaw.

Though, who could blame you? School doesn't really teach students about money. We don't truly learn what taxes, interest, or dividends are. Of course, it will get mentioned in class about politics and economics, but you will never truly apply it, and more or less learn about financial systems that will never genuinely help you as an adult.

Additionally, adult live holds numerous traps if you simply do not care much about managing your income. Even humongous sums of money won't fix poor financial management. Just think of lottery winners who lost the money faster than they obtained it.

Countless people aren't even aware that factors like rising prices make it really unwise to just hold your money on your bank account and never invest. The stock market is a great tool to fight inflation, and many people miss the opportunity.

I think, before jumping into the job life, consider educating yourself about finance. Research about mistakes to avoid and methods to cultivate and invest your money. Because preparing in your youth could really make the difference between financial freedom instead of a stressed-out parasitic job. Even better, 4-hour workweeks.

So, how do you actually start? You could just jump in and read about trading, dividends and other terms you might not yet understand, but I can recommend another way. When it comes to learning, just reading and watching YouTube videos or short financial tips on TikTok won't really hold long-term. I believe in the application of knowledge, or, learning by doing.

What do I recommend then?

1: Install free Paper-Trading Software

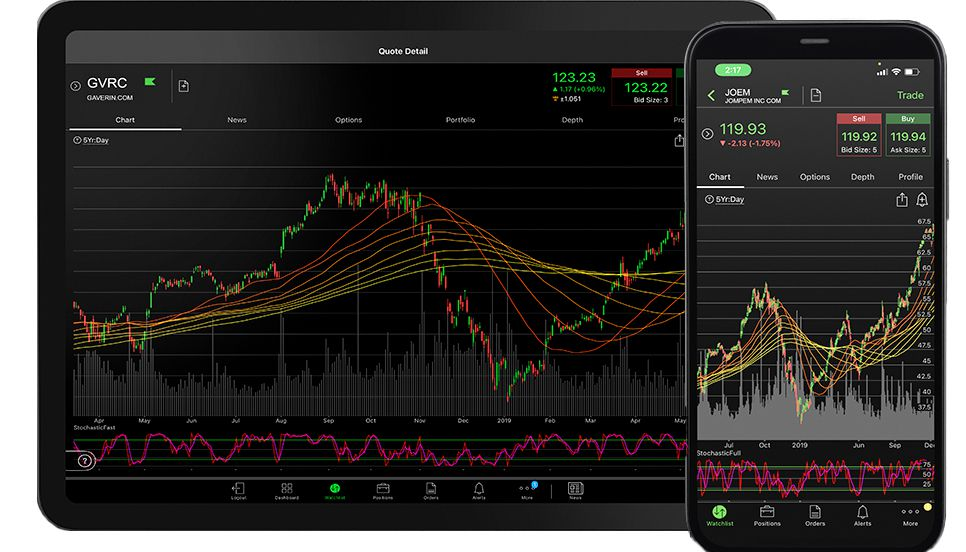

The first point would be to install a free Paper-Trading Program to Swing-Trade.

To explain potentially unknown terms, Paper-Trading means that you buy and sell stocks in a fictional environment which is synchronized with the real market (but usually delayed). You don't pay in real money but instead typically start with 25000 to 200000 Dollars of fake-cash.

With Swing-Trading, I'm referring to buying and selling stocks over longer periods of time and not profiting off volatile minute fluctuations. It means that you buy 100 Tesla Stocks and hold them for around a week and see if you made some money.

What this allows is that you literally get a hands-on approach to a stock market to mess around with. You can buy and sell anything you want and whilst bad trades might make you sad, they won't destroy your life. If you are scared by the numbers, complex terms and unreadable charts, don't be discouraged! Watching 1 hour of tutorials about your software will typically suffice for you to start buying and selling. The rest will come with time.

The image is from the software that I actually use, which is called Think or Swim by TD Ameritrade. It is free to use if you want to paper trade and is widely used by professionals. The software also offers a mobile app, so I'm also able to make some financial decisions on the go. If you want to sign up for the paper trading version, then just visit the link I provide here (and no, it's not an affiliate link):

https://papermoney.thinkorswim.com/platform/index.html#!/pmregister

2: Look at Financial news

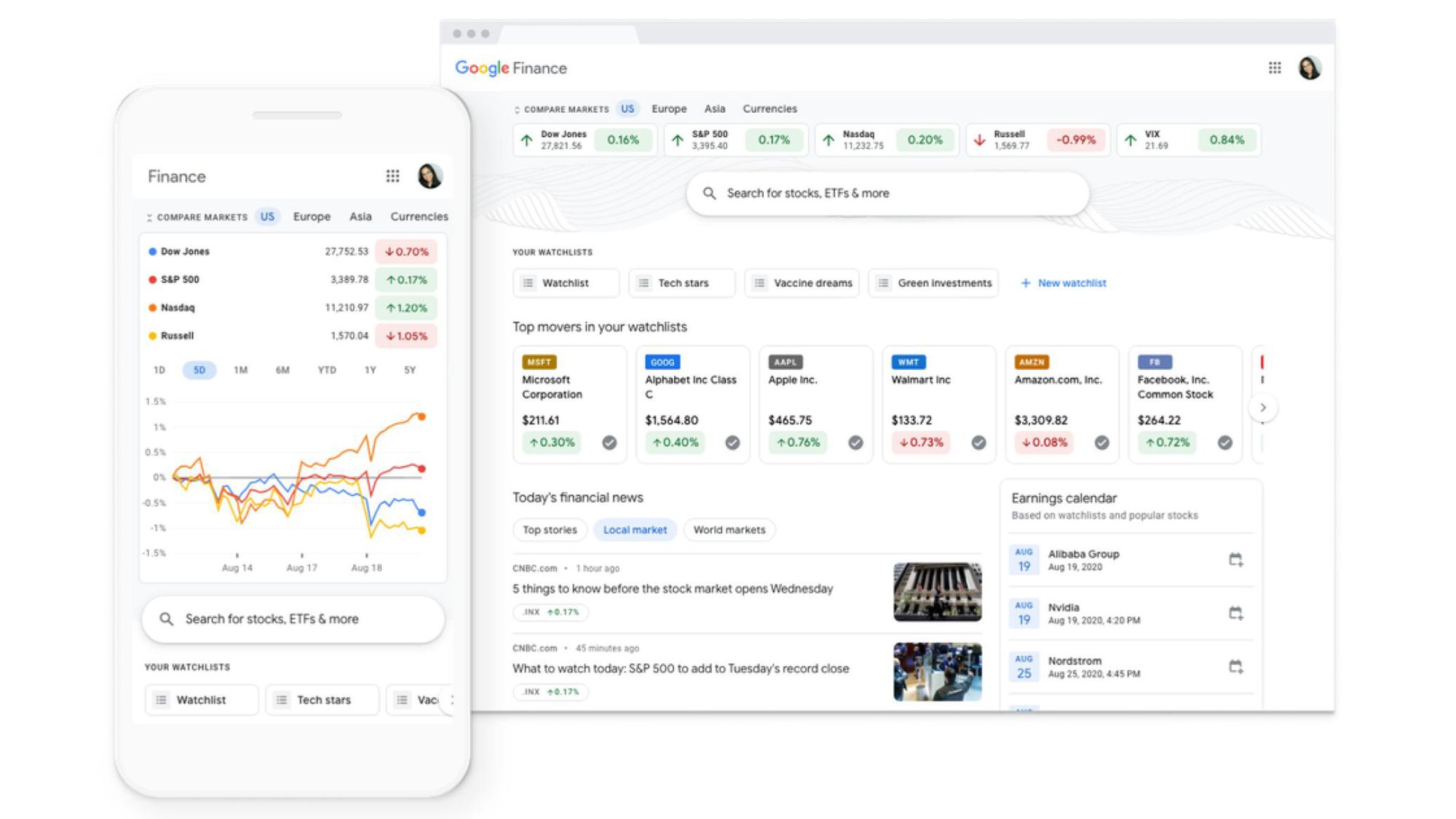

Just like reading about celebrities or general events in the world, consider reading financial news. I took me a while to find a well-balanced service that isn't that limited whilst being free.

https://www.google.com/finance/?hl=en

You can log in with your Google account and create a Watchlist to observe your favorite stocks. The bottom of the website is probably the most interesting because it normally offers the newest business headlines. You can always filter the new to your local market or just read about stock predictions, but reading some headlines daily can really move you towards financial literacy.

You can often use the information by those articles to determine potential and make better decisions in your trading software.

Btw look at the Link I pasted into the blog, the end is made of ?hl=en

If you change the “en” to for example to “Ge” then you switch to the German version of the website which will logically show you other news which relate more to the European market. Google finance is a great opportunity if you want to avoid paying $40 every month.

3: Read books about economics

There are some excellent publications which make you a lot wiser in managing your monetary system. I know you could read some articles online or watch courses and Videos, but books regularly offer so much more.

I won't really go much further into this because it's pretty straightforward. I already recommended the millionaire fastlane by MJ DeMarco, you can read the summary in the properly named blog post which I wrote a while ago.

Anyway, dip your toes into one of those possibilities, and at best, all of them. Don't fall for the trap that others walk into and get financially educated.

Consider checking out my book summaries and have a fantastic next week :)